Overview of Minh Duc Industrial Park – Hung Yen

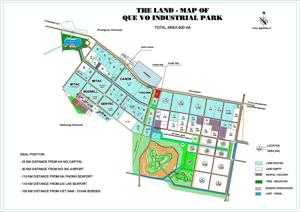

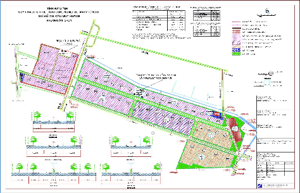

Planning map of Minh Duc Industrial Park

Minh Duc Industrial Park was established in 2007 in the area of Minh Duc commune, Bach Sam commune and Ngoc Lam commune, My Hao district, Hung Yen with an area of 200 hectares. Minh Duc Industrial Park has a very convenient traffic location, it can easily trade with neighboring provinces and cities as well as key economic centers such as Hanoi, Hai Phong, Quang Ninh, as well as quickly access seaports, road ports and airports, thereby saving a lot of costs and transportation time, especially the cost of import and export of goods. Because it is located in Hung Yen province, right next to Hanoi, and has an abundant young labor force, investors here not only have favorable conditions for recruiting and training labor, but also can save labor costs and enjoy services at cheap prices.

Minh Duc IP has a modern design, meeting all the needs of investors. Therefore, the industrial park has received 31 projects with a total land area for lease of about 39 hectares, accounting for nearly 30% of the industrial land area for lease. The investor is organizing compensation for site clearance and building industrial park infrastructure, and is expected to receive investment projects from 2018.

The total land area is 200ha, the area of industrial land that has been leased is about 140ha.

The fields that the industrial park is calling for investment are: Manufacturing and assembling electrical, electronic and refrigeration equipment; manufacturing paper, packaging, ceramics; processing agricultural, forestry and food products; manufacturing consumer goods; light industry, etc.

Geographical location:

Minh Duc Industrial Park is located along National Highway 5, on an important road connecting Hanoi with provinces in the northern economic region

- 30km from the center of Hanoi (45’)

- 50km from Noi Bai International Airport (60’)

- 65km from Hai Phong port (65’)

- 100km from Quang Ninh deep-water seaport (1h40’)

- 15km from Lac Dao station

Infrastructure of Minh Duc Industrial Park

- Road traffic system: The internal traffic system of the industrial park is reasonably designed to ensure smooth traffic throughout the Industrial Cluster. The entire internal roads are designed and constructed in strict compliance with national regulations, and are completed with Asphalt concrete. The internal roads are also equipped with a complete and aesthetic high-pressure lighting system.The road system is designed with the following dimensions:

+ The central axis road in the Industrial Park is 34 meters wide

+ The main roads in the industrial park are 24 meters wide

+ Branch roads are 14m wide

- Electricity: According to the plan, the IP will build 3 160 KVA substations and 1 31.5 KVA substation. The power supply to the industrial park is taken from the national grid 24/7. The power lines will be developed into a network along the traffic routes to supply electricity to the substations of factories in the Industrial Park.

- Water: Minh Duc Industrial Park is one of the first Industrial Parks to be supplied with clean water from the local water plant. Clean water is supplied with a capacity of 20,000 cubic meters per day from the Hai Duong clean water plant.

Clean water is supplied to the factory fence by an international standard water supply system.

In addition, to ensure a continuous supply of clean water, the Industrial Park has a water supply plant located right in the area.

- Wastewater treatment: According to the plan, the water treatment plant has a capacity of 5,000 m3/day and night. Wastewater in the Industrial Park will be pre-treated by each factory in the area to meet the type B wastewater standard according to national standards before being discharged into the drainage system of the Industrial Cluster and discharged into the Sat River.

- Waste treatment: Factory standard: Not applicable Maximum treatment capacity (Tons/day): Current waste treatment capacity (Tons/day). Waste is collected and treated at the waste treatment plant of the Industrial Cluster.

Exhaust gases from factories are installed with a filtering system according to national standards before being discharged into the natural environment.

- Fire fighting system: The fire police team is 8km from the IP; According to the plan, a system of water pipes and fire hydrants along the main and branch roads of the entire industrial park. The Industrial Park is equipped with a warning, prevention and fire fighting system that strictly complies with national regulations.

Fire hydrants are installed at internal traffic junctions and at every factory to ensure effective protection of the entire area from fire and explosion incidents.

- Information and communication: Modern information system meeting international standards, fully and quickly meeting all requirements for domestic and international information and communication services. The industrial park is installed with an underground communication cable system, and is supplied to the factory fence by an international standard cable system. Through the connection between the information and communication center of the Industrial Park and the Hung Yen Central Post Office, information and communication needs are ensured and can provide all necessary services such as private switchboard, international telephone, remote conferencing, private leased channels, high-speed internet, email, etc.

- Other information: More than 10% of the total area of the Industrial Park is planted with green trees along the roads and other areas.

Lawns and public green areas are appropriately planted to improve the environment of the entire area.

Factory and other building construction projects must be approved by the Industrial Cluster Management Board before construction is carried out to ensure the overall landscape of the entire Industrial Park.

Pho Noi General Hospital (8 km from the IP) is planned and built modernly to meet the needs of treatment and medical examination for workers in the Industrial Park.

Investment costs of Minh Duc Industrial Park

- Land rental price We are committed to offering the most competitive price in the area.

- Industrial Park management fee: 0.30USD/m2/year. This fee is paid annually in the first month of the year.

- Clean water usage fee: 0.30USD/m3. The amount of clean water used is calculated according to the index recorded on the water meter.

- Wastewater treatment fee: 0.22USD/m3. The amount of wastewater is calculated as 80% of the actual amount of clean water used.

- Electricity usage fee: according to the general regulations of the Government of Vietnam.

- Factory for rent: In addition, the Industrial Park can also build factories for customers to rent with a scale from 1,000m2 to 100,000m2.

- Factories can be built according to customer requirements, and can be put into use after 4 - 7 months of construction.

- The average factory rental price is set for factories with simple structures (pre-engineered steel frame factories with one floor): 2USD/m2/month.

Customers can choose the option to buy back the factory after a period of rental

Investment incentives of Minh Duc Industrial Park

When investing in Minh Duc Industrial Park, investors are entitled to tax incentives according to State regulations as follows:

A. Corporate Income Tax incentives:

- For projects encouraging special investment: the tax rate is 10% of profits for 15 years from the date the investment project officially goes into operation and 28% for the following years. Corporate income tax exemption for 4 years from the application of corporate income tax and a 50% reduction for the next 9 years.

- For production and business projects: the tax rate is 15% of profits for 12 years from the date the investment project officially goes into operation and 28% for the following years. Corporate income tax exemption for 3 years from the application of corporate income tax and a 50% reduction for the next 7 years.

- For service business projects: the tax rate is 20% of profits for 10 years from the date the investment project officially goes into operation and 28% for the following years. Corporate income tax exemption for 2 years from the application of corporate income tax and a 50% reduction for the next 6 years.

In addition, businesses with export activities of over 50% of the product value are entitled to additional tax incentives as follows:

+ Reduce 50% of the tax payable in the year for the following cases: direct export in the first year; exporting products that apply new technology and products with different technology from previous products; exporting products to new markets

+ Reduce 50% of the tax payable in the year for businesses with export revenue in the following year higher than the previous year.

+ Reduce 20% of corporate income tax payable in the years for the following cases: revenue from exports accounts for more than 50% of the enterprise's total revenue, the tax reduction is applied annually; enterprises with stable export markets in terms of quantity and revenue for 3 consecutive years.

B. Import Tax Incentives:

- Exemption from import tax on goods imported to create fixed assets including:

- Equipment, machinery

- Specialized vehicles in the technology chain and vehicles used to transport workers (Cars with 24 seats or more)

- Components, details, separate parts, spare parts, jigs, molds, accessories accompanying equipment, machinery, means of transport and specialized transport

- Raw materials and supplies imported to manufacture equipment, machinery, separate parts, spare parts, jigs, molds, accessories accompanying equipment, machinery in the technology chain

- Construction materials that Vietnam has not yet produced

- Import tax exemption also applies to project expansion or application of new science and technology.

Exemption from import tax on raw materials for production within 5 years from the start of production, if investing in projects on the list of projects encouraging special investment.

- Exemption from import tax on raw materials and supplies imported for export production within 5 years from the start of production, if investing in projects producing mechanical, electrical and electronic components and spare parts.

- Exemption from import tax on raw materials and supplies imported for export production or for manufacturing products for other enterprises to directly use to manufacture export products.

- Temporary exemption from import tax on raw materials and supplies imported for export production in accordance with the Law on Import and Export Tax.

C. Value Added Tax Incentives:

- Temporary suspension of payment of Value Added Tax on raw materials and supplies imported for export production during the period of temporary non-payment of Import Tax in accordance with the Law on Import and Export Tax.

- Exemption from Value Added Tax for the following cases:

- Equipment, machinery, specialized means of transport in the technology chain

- Import to create fixed assets of construction materials that the country has not yet produced

- Raw materials imported to manufacture products for businesses that directly manufacture export products

- Products and services of export processing enterprises for export or exchange

- Incentives on profit remittance abroad: the tax rate is 3%

Investing in Minh Duc IP, investors will enjoy the following advantages and incentives:

In order to create more favorable conditions for investors when investing in the Industrial Park, the investor is willing to support the following services in the shortest time with the most reasonable cost:

- Consulting on business establishment and applying for investment licenses.

- Business management services.

- Financial and accounting services for businesses.

- Design and construction services.

- Import and export services.

- Insurance services, customs procedures and warehousing.

- Goods transportation services.

- Accommodation services for experts

The Industrial Park also sets aside a land fund to build other living support services such as commercial stores, food stores, health care facilities and kindergartens, as well as vocational training facilities for workers and technical staff.

Cooperating with OceanBank bank, the Industrial Park is fully capable of providing financial support to investors to implement projects and build factories.

Our services:

With many years of experience in consulting on land laws, surveying and working with management boards of industrial parks, foreign investors in industrial parks, we provide a comprehensive service package for domestic and foreign investors in industrial parks nationwide including:

- Consulting on land law, real estate

- Survey service, visiting factories, industrial park land

- Legal services for applying for business licenses, investment certificates in Vietnam

- Legal consulting services: Drafting, Negotiating, Signing contracts

- Notary service, authentication, support for deposits, bank loans.

For detailed information, please refer to the parameters below.

VIEW MORE FULL INFORMATION DETAIL

Tiếng Việt

Tiếng Việt English

English 한국어

한국어 日本語

日本語 中文(中国)

中文(中国)

![Bac Giang Industrial Park - [[ENT_1]] Province](/upload/industrypark/industrial_park_khu-cong-nghiep-dinh-tram-tinh-bac-giang_1_small.jpeg)